Nintendo Stock’s Franchises Warrant A Higher Multiple (OTCMKTS:NTDOF)

nicescene/iStock Editorial by means of Getty Images

Nintendo (OTCPK:NTDOY) is a single of the most recognizable models on the world, and it also constitutes an intriguing financial investment possibility. With valuable manufacturers going fairly untapped, but also improving upon economics for its videogame goods, it seems attractive at solitary-digit multiples bolstered by massive money balances. With required returns needlessly large because of to weak balance sheet optimization, but also franchises that rival Disney’s (DIS), we consider that there is very long-term upside in the stock in addition to good resilience in a recessionary ecosystem.

The Nintendo Economics

Whereas Xboxes and PlayStations generally each have most of the same titles, Nintendo has generally taken a distinctive approach where their have manufacturers release on their own consoles completely, eschewing partnership with most of the titles that get unveiled on the Xbox and the PS. This has always been the design and it ends up doing work for the reason that the Nintendo makes and titles are so related, in some situations the most appropriate, in the entire world. Although in the previous the business ran with extra consoles per generation, divided among handheld and residence consoles- in before days the GameCube and the Gameboy and later on the Wii and the DSes – now almost everything is centered on one console that manages to do both of those quite effectively, the Nintendo Swap. With on the net gaming on the switch necessitating a subscription, the success of switch gross sales is essential to expand a profitable mounted foundation, the two customarily as a medium to play Nintendo titles on, but now also for the subscription earnings for Nintendo on the net.

Q4 Earnings

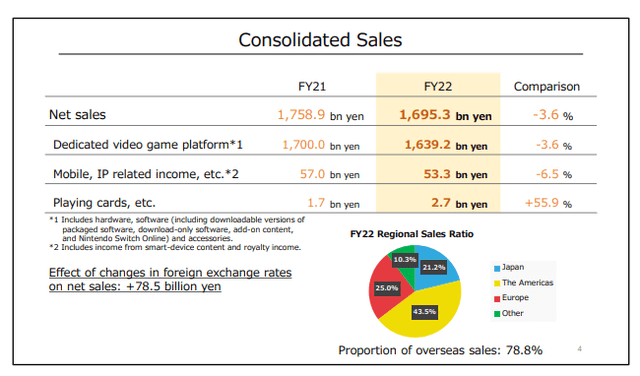

The product sales of the change gadgets in terms of volume have fallen 20% YoY. The consequences are that 2021 is a remarkably rough comp for the videogaming field, but it is also thanks to some concerns with the supply-chain hampering device gross sales. This of training course impacts the growth in the mounted foundation and advancement in subscription revenues, but be informed that billing vs revenue recognition results are in engage in here, exactly where revenues recognized on subscription profits lags the real earnings commitments made. New releases have been offering perfectly. Pokemon: Arceus, my personal favored so significantly, has been a significant strike, currently being outsold only by the combination of Outstanding Diamond and Shining Pearl of Pokemon franchise releases. New Mario and Zelda titles are selling decently as very well, and the launch of Nintendo Switch Sports activities in April will surface in the upcoming earnings slated for presentation in August. All round, we get small declines in web gross sales, with some catch-up staying awaited from subscription money.

Income Highlights (FY Charts 2022)

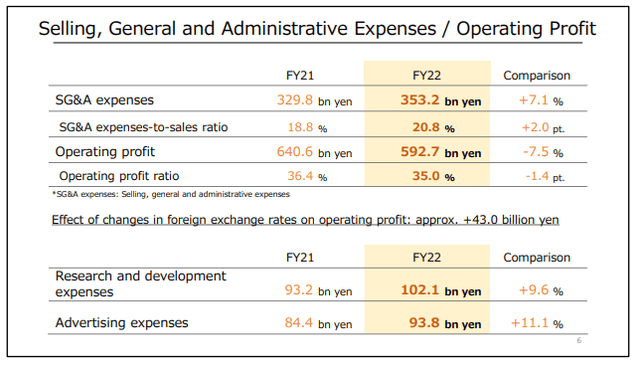

The other detail to fork out interest to is Forex consequences. The Yen is weakening fast as of the divergence in tightening policies involving Japan and the West. Forex consequences have previously impacted the income statements as of the FY report, triggering SG&A to rise with some incurred charges from US operations in bucks reflecting negatively in the presentation currency.

Expenditures (FY Charts 2022)

Valuation

The firm generates enormous dollars flows. EBITDA to OpCF conversion is additional than 100%, and the most important investments are expensed as R&D and marketing. EBITDA to FCF conversion is about 80%. The hard cash balances are significant, and the corporation carries a web income place equal to 25% of its existing industry cap. There is no leverage to talk of. This constitutes some of the upside we see in the business. Stability sheet optimization would go a pretty lengthy way for a business that generates an working income margin of 36% with just about full income conversion from accrual figures. With superior financial debt potential but no credit card debt to communicate of, the option for Nintendo to strengthen its price tag of cash is definitely there, especially in Japanese denominated personal debt, which is still trading at low yields owing to the BoJs continuing monetary lodging. Charge of funds could tumble as a great deal as 50 percent for Nintendo, and mainly because of the compounding influence of discounting, the good value of the stock could grow by substantially additional than 2x.

So the small charge leveraging possibility is nonetheless to some degree available to Nintendo and it would be of great advantage to shareholders. The enterprise trades at an 8.31x several on ahead EBITDA, and with the foundation results going to be completely digested by the end of the coming fiscal yr, advancement ought to be again on track at consistent and appealing natural and organic rates reflecting its productive platforms and its continuing incumbency in videogame manufacturers. With a revaluation of the stock less than a a lot more aggressive stability sheet, the a number of really should at minimum double if not extra, taking into consideration that Activision Blizzard (ATVI), whose goodwill in the field is really in the deep adverse balances now, was acquired for practically 17x, in spite of its additional ailing franchises and a incredibly about point out of its Overwatch League, with Overwatch 2 promising just about absolutely nothing in way of matchmaking or video game improvements.

Conclusions

There are some risks. The yen proceeds to depreciate, which signifies you could see depreciation of your Nintendo holdings as the Yen weakens with the BoJs place on financial lodging continuing and backed by pretty robust conviction. Even so, whilst their Yen denominated dollars balances, SG&A expenditures and other costs incurred in USD may continue to inflate with the Yen depreciation, Nintendo product sales are considerably bigger than their costs, and their gross sales are probably far more skewed to the Americas than their costs would be with scale attained in The us as this is their greatest current market. For that reason, the depreciation of the Yen actually advantages the organization overall. The query is irrespective of whether this profit will be mirrored in how the share rate develops. With the economic downturn getting another problem, albeit a lesser a person due to the fact Nintendo product sales ought to be relatively inflation resistant, specially to the extent that its product sales and subscriptions come from young children accounts, volatility need to be predicted in the price. With Japan still getting an vital industry for Nintendo, and just one that does not chance a purchaser deleveraging owing to continued financial lodging, there are even further offsets for Nintendo that make it attractive.

Last but not least, its franchises can carry on to be leveraged. The theme-park and IP chance is significant, where recent IP based mostly revenues are continue to incredibly little. As reopening proceeds, there are prospects to leverage its IPs, which includes Mario and Pokemon which it significantly owns, into a Disneyesque ecosystem. With the IPs currently being main to Disney’s organization product, and a huge supply of top quality in their shares, we feel Nintendo can replicate that a single day. Although a latent resource of earnings, the IPs help this for Nintendo, and the optionality there shouldn’t be dismissed.

Total, with the fundamentals getting really sound, and the opportunity for shareholder value generation coming from small-hanging fruit, we assume Nintendo is a obtain.