Academy Sports Is A One-Foot Hurdle (NASDAQ:ASO)

matimix/iStock via Getty Images

Thesis

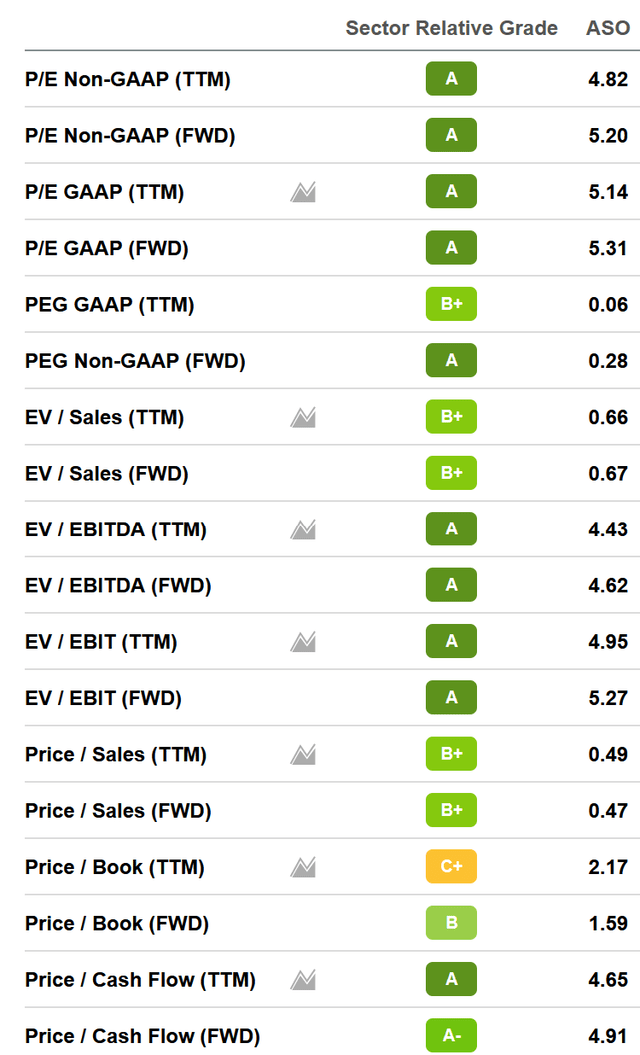

Academy Sports and Outdoors, Inc. (NASDAQ:ASO) looks cheap based on traditional valuation metrics. The market doesn’t believe that the current earning levels are sustainable.

ASO valuation metrics (Seeking Alpha)

Management is guiding for a slowdown in sales of between 1-3% and GAAP EPS of between $6.55 and $7.10. The market is expecting a much larger slowdown. So, the question to answer is if we believe in management guidance or the market’s valuation.

The current valuation and improved balance sheet should help protect our downside. At the same time, ASO recently restarted opening new stores. If their push to open new stores is successful, we could see increasing cash flows and potential multiple expansion.

Unit economics

ASO began expanding its store count again in 2022. They plan to open 8 new stores this year. New store locations are expected to cost $3.5MM per store.

In 2021, Academy earned $3.9MM in EBITDA per store. New stores won’t perform at the same level as existing stores, but this gives a rough idea of the attractive incremental return on capital that ASO can achieve by opening new stores. Since ASO is currently only a regional player, they have a lot of room for expansion.

ASO key unit level metric compared to competitors 2020 (ASO investor relations)

This paints a high upside scenario if ASO can maintain near its current operating performance. In this upside scenario, ASO can use its ample cash flow and favorable unit economics to steadily grow its revenue and future cash flows by opening new stores.

ASO is not hurting its downside scenario by re-engaging its expansion. They aren’t taking on debt, outside of operating leases, paying for these new locations out of their cash flows.

Previous financial performance

To understand what might happen if sales decrease, I looked back at previous periods before the pandemic. If we look back at the fiscal year 2019, the company earned $1.66 per share. However several things have changed since then. The company paid off a large amount of debt and refinanced the rest at a lower interest rate, this should save the company $57.8MM compared to fiscal 2019 in interest payments. ASO also bought back shares, reducing its diluted share count by 20%. With only these adjustments, we have a clear line of sight on an EPS of $2.37.

An EPS of $2.37 would be disappointing. But, we are not giving the company credit for other improvements they have made. For example, ASO improved its gross profit margin from 29% to 34%. Management claims the improvement is from better supply chain and inventory management.

Strong leadership

ASO’s CEO is Ken Hicks. Ken took over the job in 2018, when ASO was still private. Since Mr. Hicks took over, he has delivered strong results, consistently achieving the goals he lays out and beating guidance. You might rightly point out that since ASO went public in 2020, the macro environment has been near perfect for ASO.

However, before ASO, Mr. Hicks was the CEO of Foot Locker (FL) from 2009-to 2014. During his tenure there as CEO, FL returned $1.2B to shareholders, and its market cap expanded from $1.2B to $8B. This is an impressive resume, and ASO is currently paying him well. However, his large compensation is tied to achieving the company’s revenue and adjusted EBIT goals.

Risk – With the pandemic ending, consumers will spend less time outdoors

One worry with ASO and other outdoor-focused retailers is that people have been buying more of their products because of the pandemic and lockdowns. As the pandemic ends and the world opens up, an average customer will spend more time on activities they couldn’t do during the pandemic. Naturally, the consumer will spend less time and money on their pandemic hobbies.

Generally, I believe that pandemic hobbies will be sticky to some extent. While not everyone who took up hunting, golfing, or another outdoor activity will stick around, some will. That should provide a lift over ASO’s 2019 profit levels. In addition, some activities that ASO sells products for, such as team sports, were limited during the pandemic.

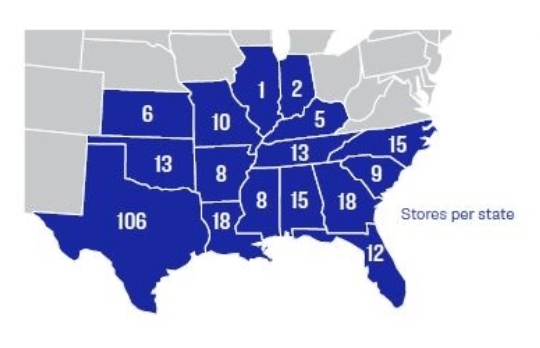

In ASO’s case, re-opening has already begun to play out. ASO is located exclusively in the southern united states. The states in which ASO operates ended their Covid-19 restrictions much sooner than the rest of the US. In ASO’s largest market, Texas, lockdowns and mask mandates were ended over a year ago.

ASO stores per state (ASO investor relations)

Risk – Consumers’ spending is being hurt

Last year, consumers were enjoying stimulus checks. This year, they are having to deal with inflation eating into their spending power. Consumer confidence has been trending lower. In addition, Wall Street seems to believe that an economic recession is imminent.

I’m skeptical of Wall Street’s ability to predict a recession. One may very well be on the horizon, but I don’t think anyone can accurately predict it. I generally do bottom-up analysis and don’t try to time recessions.

So far, ASO has been able to navigate inflation and supply chain issues to maintain its current level of profitability. One reason might be because ASO positions itself as a low-cost provider in the categories it sells in. Low-cost providers can gain market share when the consumer is under pressure.

In addition, ASO has used the last two years to improve its balance sheet. They have greatly reduced the debt other than capital leases on their balance sheet. They currently owe $683MM, down from $1.4B when the company went public in 2020. None of their loan principal is due until 2027. This should help them to survive any hard times.

Valuation

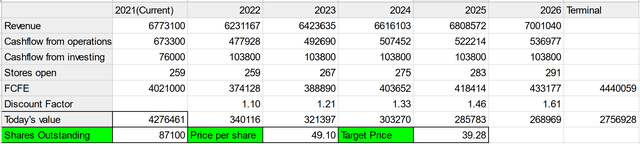

I’m going to use a discounted cash flow analysis to value ASO. The discounted cash flow analysis is meant to be used as a high-level guide. I’ve made several assumptions in the analysis that affect the final value. I try to be conservative when making these assumptions which are as follows.

Based on historical performance, new stores will add $24M in revenue yearly, and 7.7% of revenue will be converted to operating cash flow. ASO will spend 75 million a year on CAPEX outside of opening new stores. Based on management’s guidance projected forward. ASO will open 8 new stores a year costing 28 million per year for the next 5 years.

This is based on my investing principles: a required rate of return of 10%, 5 years of growth before reaching a perpetual growth rate, a perpetual growth rate of 2.5%, and a margin of safety of 20% from my price target for my buy price.

Author’s work

Final thoughts

ASO appears undervalued. I believe it is being punished for two reasons. One, ASO was grouped in with the COVID winners. Two, the market is beginning to price businesses for a recession. There is likely some truth to both of the market’s worries. I believe they are more than priced in at ASO’s current valuation.

Buying ASO at the current price is a bet that the stock’s future earnings won’t decrease dramatically. In my mind, ASO, at its current price, offers a combination of downside protection and potential for high upside. If management can grow the business, we could see increasing cash flows alongside multiple re-rating.

I’ve built a position when the stock trades below $40 this year. If ASO dips to around $30 again, as it did in March, I’ll likely make ASO a larger part of my portfolio.